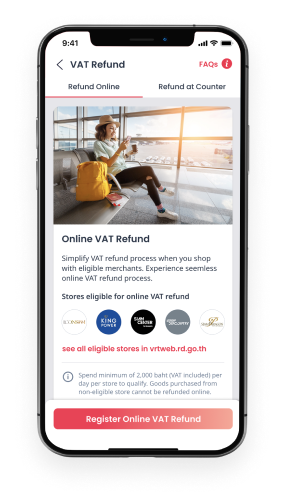

Online VAT Refund

Simply Request for a VAT Refund on TAGTHAi App

It’s Easy & Convenient

Online VAT Refund

Simply Request for a VAT Refund

on TAGTHAi App

It’s Easy & Convenient

What is Online VAT Refund?

Those who shop tax-free at eligible stores can obtain a VAT refund online right on TAGTHAi Application.

Skip the queue & lengthy process at the airport,

download TAGTHAi App now!

Skip the queue & lengthy process at the airport, download TAGTHAi App now!

How Easy?

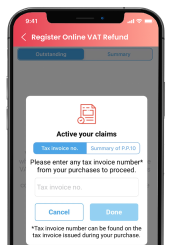

Simply fill out the invoice for the first time. The next time you purchase

the app will automatically sync the invoice for you.

Simply fill out the invoice for the first time.

The next time you purchase

the app will automatically sync the invoice for you.

It’s very convenient!

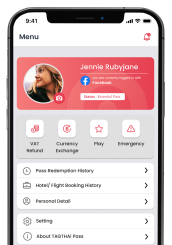

How to use?

STEP 1

Enter to VAT Refund Menu in TAGTHAi Application

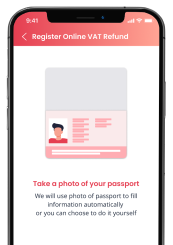

STEP 2

Take a photo of your passport information "OR" fill out the form

STEP 3

Set up an account on VAT Refund portal to start your request. You will need to fill in the invoice on your first time.

Condition

Who can claim a VAT Refund in Thailand?

- Those who do not have a residency in Thailand.

- Those who are not airline crew members departing Thailand on duty .

- Depart Thailand from an international airport.

- Purchase goods from eligible stores displaying a "Vat Refund For Tourists" sign.

- Present the goods and VAT Refund Application for Tourist Form (e-P.P.10) and original tax invoices to the Customs officer before check-in at the airline counter on the departure date.

VAT Refunds will not be made under these condition:

Eligible stores